The news changes day by day, but here’s what we know about help for small businesses during COVID-19 as of June 12, 2020.

Help with staffing costs while business slows down

1. Wage subsidies – 75% CEWS and 10% CRA subsidy

The Canada Emergency Wage Subsidy (CEWS) information portal is live and is now open for applications. Those who qualify will receive funds directly from the government. Set up a CRA My Business Account and your direct deposit information to help get the funds flowing quicker and easier.

For employers that are keeping or rehiring staff but need help with payroll costs, CEWS is a 75% wage subsidy program for qualifying businesses and non-profits of all sizes. Retroactive to March 15, 2020 and now ending August 29, 2020, the subsidy will be up to $847/week per employee. Employers are strongly encouraged to top up the remaining 25% of wages themselves. For those with employees on paid leave, there are also refunds available on employer-paid contributions to programs like EI and CPP.

Who qualifies for this large subsidy? Employers whose gross revenues have declined by at least 15% due to COVID-19 in March, 30% in April, and 30% in May, when compared to the same month in 2019 OR the average of January and February 2020. Read more details and examples here.

An immediate, temporary wage subsidy – via savings on income tax remittances to the Canada Revenue Agency (CRA) – is also available for a period of three months (March 18-June 20, 2020). “Effective immediately, eligible employers […] are permitted to reduce remittances of federal, provincial, or territorial income tax by the amount of the subsidy. This measure is only applicable to remittances made to the CRA.” Note: “For employers that are eligible for both the CEWS and the 10 per cent wage subsidy for a period, any benefit from the 10 per cent wage subsidy for remuneration paid in a specific period would generally reduce the amount available to be claimed under the CEWS in that same period.”

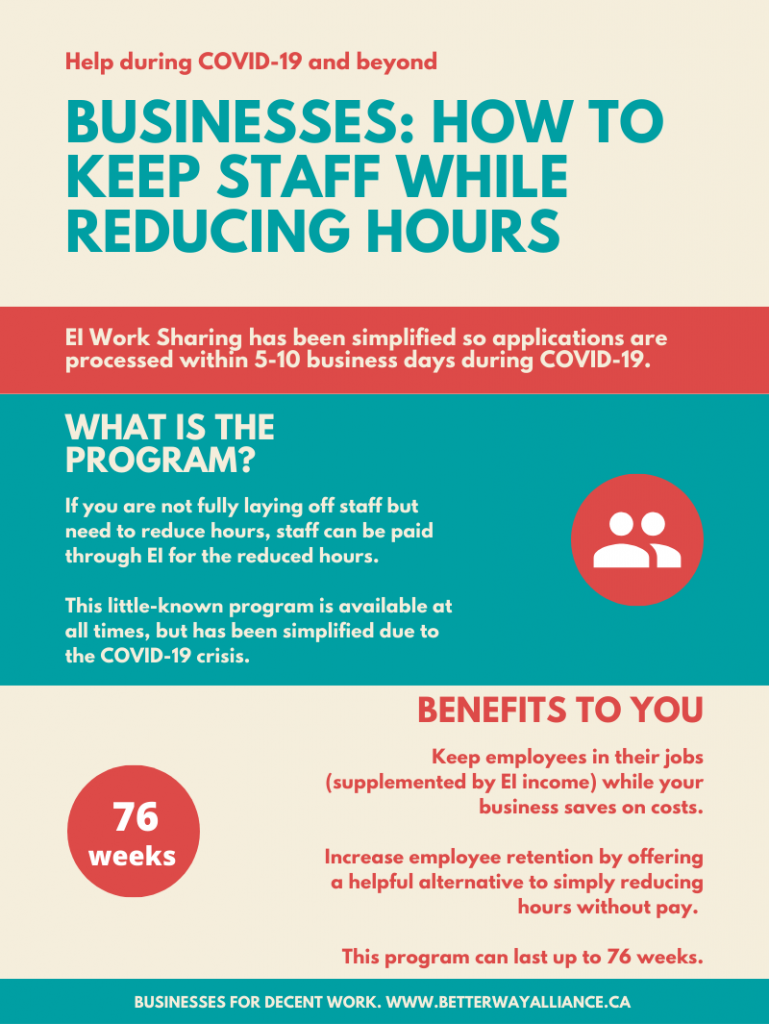

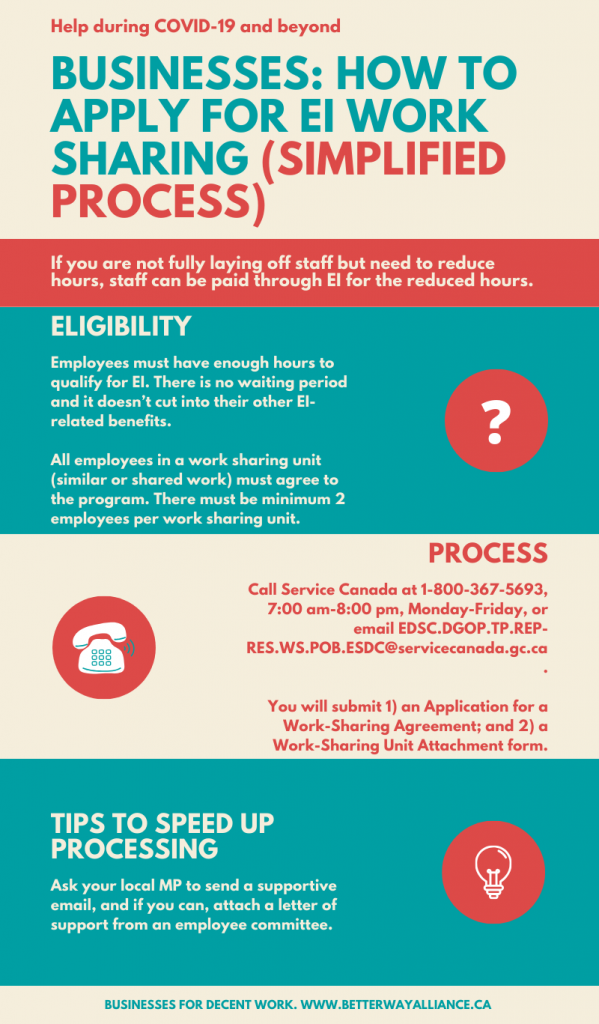

2. Employment Insurance Work Sharing

EI Work Sharing is a program to cut days/hours and have employees collect EI for the days/hours they are not working for you. All employees in a work sharing unit must agree and sign on. There is no waiting period and it doesn’t cut into employees’ other EI-related benefits. Benefits to you: keep people in their jobs (supplemented by EI income) while your business cuts back on costs. This program can last up to 76 weeks. One caveat: the employees have to have enough hours to qualify for EI, otherwise they can’t participate in this program. Work is underway to streamline this program for small employers. But we should make these changes permanent and think through ways to make this program work better for small and medium-sized businesses on a go-forward basis.

3. Supplementary Unemployment Benefit Program

If you must lay off staff but hope to retain the same staff for future work, you can consider the Supplementary Unemployment Benefit Program. Now with a shortened and simplified application process, you can opt to voluntarily top up staff earnings while they are on EI (and that top up will not take away from their EI earnings).

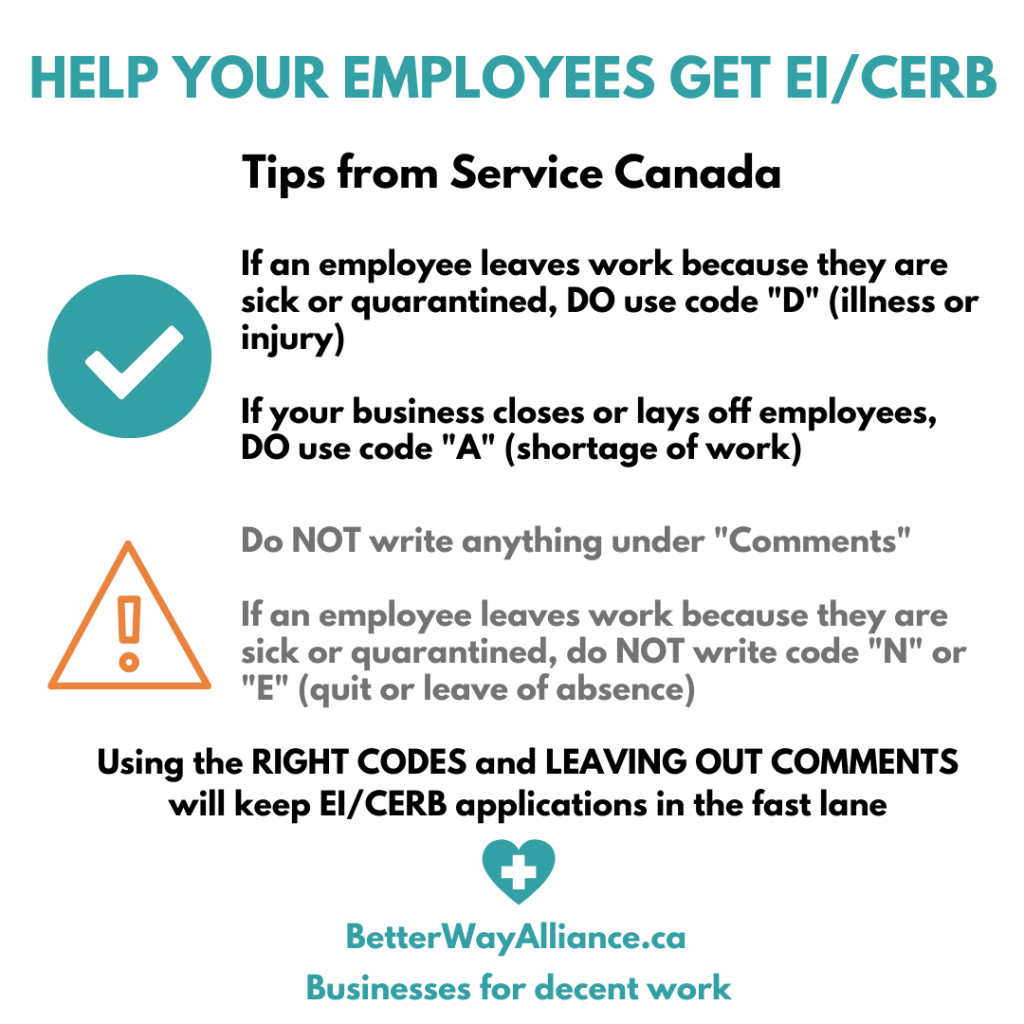

4. Help employees get Employment Insurance/Canada Emergency Response Benefit – tips from Service Canada

Help with cash flow

5. Commercial rent relief

Commercial rent is the biggest fixed, “overhead” cost for many small and medium businesses.

With many of us forced to close for public health reasons, we need help now so we can afford to re-open as soon as it’s safe. Commercial rent relief must take into account the time needed for consumers to return to our businesses and for spending to return to pre-crisis levels.

Applications are now open for commercial landlords to apply for the Canada Emergency Commercial Rent Assistance (CECRA) program. Ask your landlord to apply. This program comes in the form of forgivable loans to commercial landlords for the months of April, May, and June. Tenants whose landlords apply for the program and pass on the funds could retroactively save 75% on rent for those months. Unfortunately, the program relies on the good will of landlords to apply.

The Ontario government is putting a temporary commercial evictions ban in place for businesses who qualify for CECRA, from June 3 until end of August 2020.

6. Business loans

The new Canada Emergency Business Account (CEBA) will offer small business bank loans of up to $40,000, interest-free for the first year. Up to $10,000 of each loan may be forgiven. The loans are now available through major banks to businesses that spent between $20,000 and $1.5-million in payroll in 2019. Details here.

There is also increased access to business loans through the Business Development Bank of Canada (BDC), Export Development Canada (EDC) for businesses involved in trade, and Farm Credit Canada for the agriculture sector.

7. Tax payment deferrals

Businesses can defer income tax owing to the CRA until after August 31, 2020 (for payments that become owing before September 2020).

There is a CRA Liaison Officer service available online to business owners to help us understand tax obligations.

Other possible supports depending on your business

8. Check with your provincial government

Your province may have other supports available to small businesses. Check your provincial government’s website. For instance, the Ontario government has announced tax payment deferrals and a temporary reduction in electricity rates.

9. Check with your municipality

Your municipality may have other supports available to small businesses. Check your municipal government’s website. For instance, the City of Toronto has announced tax and utility bill payment deferrals.

The Better Way Alliance is a growing movement of businesses supporting decent wages, paid sick days, and fair scheduling laws. Decent work is good for business. Our members employ more than 30,000 Ontarians. Industries represented include services, retail, food and beverage, and manufacturing.

Recent Comments